Financial Review: May 2019

PURPOSE

In support of my 2019 Goals, I plan and track my income, savings & spending in a monthly budget.

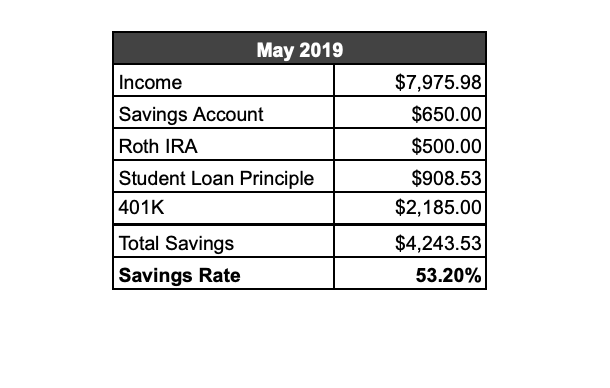

In addition to my annual goal, I also compete (with myself) to have the highest possible monthly savings rate—I aim for 70%. Savings rate is often considered a benchmark for financial health and a brag worthy metric.

DEFINITIONS

Savings rate calculations can be open to interpretation, so here are the definitions I’m working with:

Savings = anything that increases my net worth:

401k contributions

Roth IRA contributions

principle payments on a loan

savings account contributions

Income = take home pay + 401k contributions

Savings Rate = Savings / Income

THE NUMBERS

SAVINGS RATE: MAY 2019

SAVINGS BY TYPE: MAY 2019

INSIGHTS

I had surgery on 4/18/19, so the month of May saw financial irregularities related to recovery:

Lyft & Uber rides to and from work

reduced income from taking time off of my part time job

increased food spending because I brought less food home from my part time job

Even though I took time off from my part time job, I still managed to bring home nearly $8k because May was a 3 paycheck month—I got paid on the 3rd, 17th and 31st.

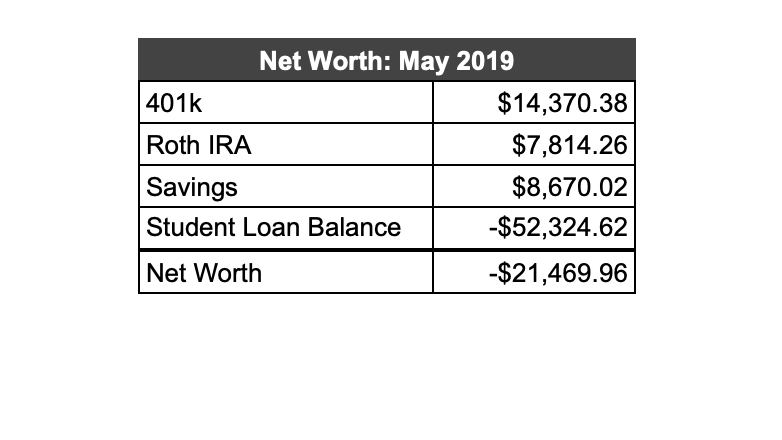

The stock market declined in May, so while I contributed $500 to my Roth IRA, the value of my portfolio only increased by $14. Not to worry, I was able to make my final contributions of the month during this “sale”. In other words, I was able to pick up more shares this month than last month even though I contributed the same dollar amount. As the price per share increases over time, I’ll see the value of my portfolio increase. And while I don’t actively partake in market timing, I did enjoy May’s dip.